How It Works

The Structure and Funding of Your Life Insurance

Strategy

Once we have uncovered a family’s need for life insurance and agree on the purposes this strategy fulfills, then we brainstorm with their legal team on the ideal ownership structure for that policy and decide on the best funding option – self-funded or premium financing.

Should self-funding be ideal for the family, we advise on payment structure and timing to ensure it aligns with their overall wealth management strategy.

Should premium financing be the option of choice, we work to establish the appropriate loan structure from underwriting to implementation.

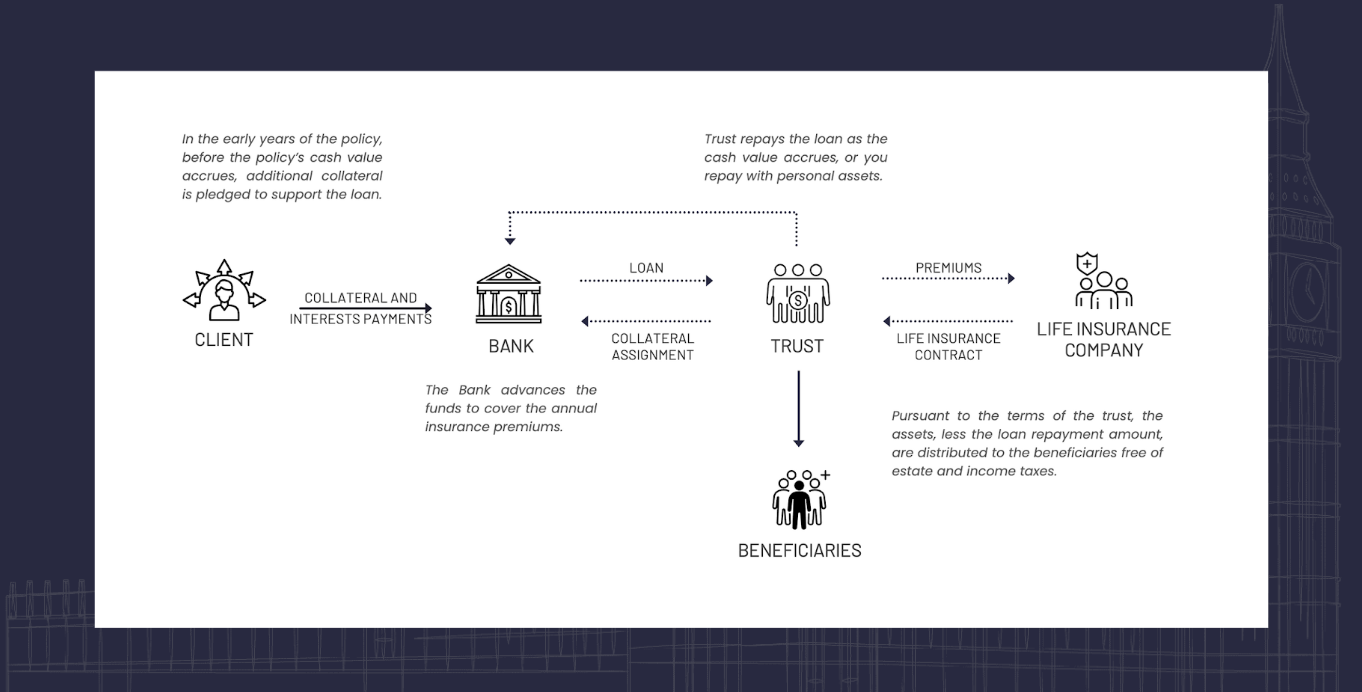

The Estate Structure and Benefits of Premium Financing

Premium financing is a suitable strategy for high-net-worth individuals, families, and businesses who wish to use life insurance to provide the liquidity necessary for the estate to achieve the wealth, succession, and legacy goals set forth by the family.

THE ESTATE STRUCTURE

POTENTIAL BENEFITS OF FINANCING THE PREMIUMS

Ensure you get the adequate amount of coverage needed without affecting your cash flow or depleting other assets to pay for it.

Retain your capital to be used for investing rather than paying outright for life insurance premiums.

By not paying the premiums directly, your money has the opportunity to outperform the borrowing costs of the loan.

The funds that the trust borrows to pay the premiums and interest expenses are potentially available free of gift taxes.

Create an alternative liquid asset class through the cash values of the policy, to access during your lifetime in a tax-efficient manner once the bank loan has been repaid.

CONSIDERATIONS:

As part of our education process, we collaborate with the family’s wealth, legal and tax advisors to evaluate the inherent variables of a borrowing strategy, including interest rate fluctuation, market volatility, the possibility of a collateral shortfall, etc.